As you might have expected, there is a lot to talk about this week. So much so, that we turned this Weekly Review into a ‘Special Edition’ variety.

In the revised estimate, first quarter GDP growth was adjusted from 2.2% down to 1.9%. This would probably not be as surprising or impactful in its own right, but coupled with more immediate May data, it made a negative dent on investor sentiment. The details of the report included higher final sales, while consumer spending was revised down, as was government spending (a big part of this). While disappointing, this data is now old news. Second quarter growth is expected to be a bit better, but maybe not dramatically so. Estimates have remained in the 2.0-3.0% range, although we very well could stay in the lower end of that for the time being.

The Conference Board Consumer Confidence index fell from 68.7 to 64.9 for May, which was below expectations and in stark contrast to the positive Univ. of Michigan survey the previous week. Current conditions dropped the most, but expectations also fell a bit, as did the employment portion.

The Chicago PMI also declined somewhat unexpectedly from 56.2 in April to 52.7 in May, while forecasters expected a small increase. Since the Chicago numbers had been a bit higher than the rest of the nation for several months, this could be a seen as a somewhat normal adjustment, but, regardless, this provides additional evidence that manufacturing activity has weakened during the past month or two. While the new orders, production and employment components fell, the prices paid piece was lower, so inflation was less of a concern.

The ISM Manufacturing Index declined from 54.8 down to 53.5, which was roughly in line with expectations. The underlying parts were mixed, though, as new orders gained, inventories declined and prices paid were down, while, on the more negative side, production and employment declined significantly. On a separate note, construction spending increased +0.3%, which was in line with forecast, led by an increase in private residential building.

Contrary to the other numbers, auto unit sales were very strong, as several carmakers reported sharp increases. Sales for Toyota were up 87% from a year ago, and several domestic carmakers were up at least in the double-digits. Why is this? For one, pent-up demand is helping, as the average car on the road is now a record 10.4 years old, and financing costs are very low—the type of credit boost the Fed has been looking for by keeping rates low for so long.

The Case-Shiller measure of home prices rose +0.1% for March, which was a few basis points lower than anticipated. At the same time, however, growth in earlier months was revised up a bit, which tended to counter this effect somewhat. Three-quarters of the surveyed cities showed price increases, the highest of which were in Phoenix, Seattle and Miami, while Detroit, Chicago and Atlanta continued to lose ground from a home price standpoint. It is interesting to note that the Case-Shiller series utilizes a three-month moving average, so offers more tempered results compared to competing measures like CoreLogic and FHFA. Statistics can conceal as much as they can reveal. U.S. pending home sales fell in April by -5.5% month-over-month, which was below expectations for a flat result and counter to the last six months of recovering sales numbers.

The report on the nation’s employment situation on Friday was far weaker than expected, which had a dramatic effect on markets and sentiment. Non-farm payrolls for May were only up by +69k versus an expected +150k. Now, the question is where this is coming from: either negative ‘payback’ from gains earlier this year due to some weather factors, or deeper structural issues. Construction jobs were down -28k and leisure/hospitality positions fell by -9k, which point to the weather factors to some extent. The household survey component wasn’t as bad, showing a gain of +422k jobs versus a loss of -169k in April. The unemployment rate rose from 8.1% to 8.2%—again, negative on the surface, but labor force participation also increased (the denominator of that equation). This tends to occur over time in recovery, typically when the labor market is improving, but time will tell whether that is the underlying case now or there is a reversal downward in employment prospects. Consumer spending was up +0.3% and personal income also rose by +0.2% for April.

There continues to be a lot of uncertainty in the air, and we wanted to put some of these data points into better perspective in the form of a mid-year economic update. Below are a series of questions that either we’ve been asked or have come across in our interactions with various professionals and readings.

What about Europe? Will it matter if Greece defaults?

From a size standpoint itself, Greece is not critically important to the world economy (it is roughly equivalent to a mid-sized U.S. state—to put this into perspective). The problem is about confidence and solidarity (or lack thereof) by the Eurozone as a whole. This is why we see the back-and-forth risk-on/risk-off trading week-to-week based on political sentiment and commentary. Political decisions don’t lend themselves to be modeled easily, as they’re based on the whims of the electorate of various countries and constituencies, whose moods change frequently along with conditions.

Europe is left with two primary options, essentially. The ECB (led by Germany) needs to either scoop up and/or backstop all peripheral assets, which includes Greek government debt, Spanish bank debt and any other problematic liabilities and solidify the European nations under a single unified effort. Or, the peripheral nations can be let go, essentially, which would result in a smaller, but stronger core Europe. Both outcomes have pros and cons. While one might think German voters would prefer to ‘dump’ the problematic periphery, a smaller and even more German-dominated Europe could lead to a much stronger Euro, which could actually hurt the competitiveness of the core nations (due to more expensive exports, for one reason). At the same time, while most think leaving the Euro would be disastrous for nations like Greece, nations in the past that have dramatically restructured, with immediate pain of currency devaluation and social strife have eventually bounced back to become stronger and more competitive a just a few years later (one example is Argentina a decade ago). Again, the point is not to make guesses about possible outcomes but realize each choice has side effects—knowable and unknowable. Based on poll results, the vast majority of Greeks (as well as Spaniards and Italians) prefer to remain in the Eurozone—a reflection on the economic benefits of membership. This should be kept in mind as we progress through the political posturing.

What about our own economy? Are we headed back into recession?

It doesn’t appear so. The data has softened a bit during the last month or two, as manufacturing surveys and employment data aren’t moving at the faster pace we saw sporadically in the first quarter. A few economists have surmised that some of this effect is ‘payback’ from strong gains made earlier in the year that should have been more evenly disbursed through the late spring and early summer—due to weather effects, etc.

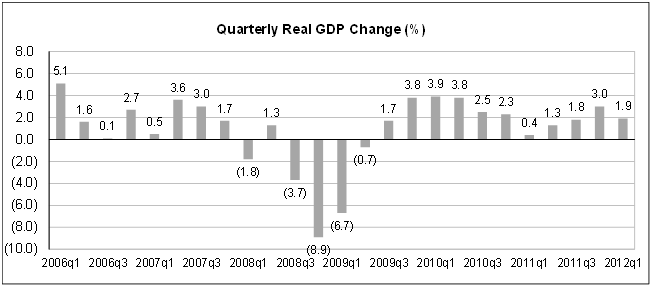

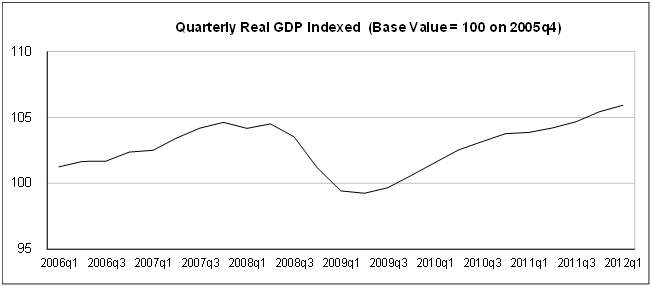

The two charts below we put together internally and put a different spin on the same data.

Source: U.S. Bureau of Economic Analysis

Both use the same government data. The first chart is choppier and data-focused (much like the news media), whereas the second chart links levels of Real GDP growth into an ‘indexed’ time series. Much less scary of a story? Yes, but not as dramatic or newsworthy perhaps. Graphics for employment and retail sales are similar.

It’s entirely possible this year could be another of ‘muddle-through’ slow growth. Recession is possible, as it always is, but recessions are usually brought on by policy mistakes, engineered through higher interest rates, geopolitical events (war, energy price spikes, etc.) or just a normal progression of the business cycle. This does not appear to be anyone’s base case currently. What is difficult about ‘slowdown’ phases (if this even is one) is that conditions are almost equally as likely to re-accelerate and continue to expand as they are to turn negative and contract from that point.

What about commodity prices?

Commodities are sensitive to a few main issues: global growth, world concerns and other idiosyncratic supply/demand situations. Over time, commodities are not generally correlated to equities or other asset classes, but, in recent years, we have seen stronger correlation as both ‘risk-on’ futures speculation and ‘risk-off’ reversals by investors have added to volatility. But the relationship of commodity prices to an economy is complex.

Oil prices have come back to earth in recent weeks. While notoriously volatile and sensitive to both economic growth itself as well as geopolitical shocks, higher oil prices are a strain on consumer and business budgets as well as raise the likelihood of recession (assuming the economy is tilted in that direction anyway). Lower prices result in lower input costs and can prove to help with consumer sentiment. If that sounds convoluted, it is, but lower prices are generally preferable to higher. In a portfolio sense, commodities as an asset class is meant to provide ‘insurance’ of sorts against inflationary and other geopolitical strife-related events that may hurt other asset classes.

What should the Fed Funds rate be?

Some economists have argued that a near-zero rate for an ‘extended period’ is excessive, considering the improvement in economic growth we’ve seen during the past two years and potential for future inflation based on this form of monetary stimulus. Based on their positioning and rhetoric, the Federal Reserve disagrees, feeling the downside risks and slow growth continue to warrant low and stimulative rates.

If we were to look at this quantitatively, through mathematical ‘rules’ intended to find an ideal rate with inputs such as unemployment, GDP, inflation, etc. (based on work from economists like John Taylor at Stanford and Greg Mankiw at Harvard, among others), ideal rates continue to point to zero (or even negative with some inputs, although it’s functionally impossible to engineer a negative interest rate—this would imply paying a bank to accept your deposit, checking and other fees notwithstanding). So, ‘quantitative easing’ was intended to create this additional stimulus not possible by further rate cuts, and continues to look appropriate to policymakers using tools like these. Will they provide more QE? They’ve been hesitant, but the weaker the data looks, the more likely officials are to consider it. Will it continue to look rational in an environment of higher inflation and improved economic conditions? Not as much.

Are interest rates ever going up?

Rising interest rates are a sign of several conditions, but generally result from either strong economic growth or inflation (the two tend to go hand-in-hand as economic growth that is ‘too’ fast can eventually result in inflation…so rising rates act as a ‘brake’ to keep this from happening). Interest rates are notoriously among the most difficult items to predict, as they are directly related to what investors are willing to pay for safety at any given time. However, we do feel that, from a probability standpoint, higher rates seem more of a threat than do lower rates. And higher rates tend to be bad news for most conventional bond investors, as is inflation—making vehicles like shorter-duration and floating rate important portfolio components in these types of environments.

Has increased ‘regulation’ hurt business? Has this hurt the economy?

This is something difficult to measure directly, and some studies argue that we are not any more ‘regulated’ than we have been in the past. However, perceptions of the regulatory environment and fear of the unknown future certainly appear to play a role in corporate decision-making. This especially affects smaller businesses who are generally less informed and feel less empowered to circumvent regulations—while such changes may or may not come to pass, a small company may postpone activities like capital purchases and/or hiring.

What about China and the emerging markets?

This has been a secondary concern as of late, and has taken a back seat to European issues, but a concern nonetheless. China does appear to be tempering, which is not unexpected considering their fast pace of growth over the recent two decades. In fact, the Chinese government is allegedly working to provide additional stimulus in the amount of $300 billion to prop up growth and keep things on a ‘soft landing’ level. Despite the reputation for being solely producers and not consumers, China, as have many emerging economies, has been experiencing increased domestic consumption steadily over the years as the economy has matured and entered into a second stage of (lower) growth. Is this a bad thing? No, but growth expectations around the world need to be adjusted to account for this…10+% growth is not a ‘forever’ condition in any nation.

At the same time, the vast majority of expected global growth in coming years is centered on the emerging markets, which are becoming larger from a market capitalization standpoint and ever-more-important players on the world stage. Despite shorter-term volatility, making a multi-year (or multi-decade, really) commitment to emerging market investments appears not only attractive but necessary to achieve the investment growth needed to meet client goals.

How about the upcoming ‘fiscal cliff?’

The ‘fiscal cliff’ is the year-end 2012 line in the sand that specifies by default, absent other actions by politicians before that time, a reversion to higher taxes (via the expiration of the Bush era and payroll tax cuts, along with a healthcare surcharge for higher-income households) and cuts in government spending as part of last year’s compromise to raise the debt ceiling.

Such a drop-dead date in the future and degree of political contentiousness looks scary, especially after the August 2011 shenanigans that led to the Standard and Poor’s decision to cut the U.S. sovereign debt rating. That said, there is a risk here, but a political one (on both sides). Extreme spending cuts for the sake of deficit reduction and tax hikes are a surefire way to shear off economic growth and potentially lead us into a (politically unpopular) recession. It wouldn’t be surprising to see political compromise and action delayed until the very last minute (again), but the stakes are especially high (again).

But my clients all say the environment is terrible?

It certainly seems that way from watching financial news. Those headlines sell more advertising than do the ‘economy is slowly improving and growing’ types of stories. Investor sentiment in general is terrible (a ‘Fear & Greed Index’ published by CNN, that an advisor recently shared with us, reads ‘fear’ to ‘extreme fear’ in almost all categories—near 2008 levels). While such measures alarm the public, what these really say is that risk assets are not popular and are heavily avoided (which is why they’re discounted). When looking beyond the immediate, this is the time to purchase them, not sell them (rationale being: if everyone is panicking, who is left to sell?). Sure, this lengthens timeframes, but timeframes should be appropriately long anyway—meaning years, as opposed to weeks and months.

That the ‘markets climb a wall of worry’ is quoted often, but it is accurate. These current issues will abate, to be replaced by new issues yet to be determined. What may be especially discouraging for clients looking to stay informed is that several academic studies, after reviewing popular financial magazine covers for many years, found a powerful reversal/contrarian effect following the publication date, so taking the opposite action of what is in the popular media has been more effective in many cases.

Is this a repeat of 2008? Have things really gotten better?

When looking at the two, there is no comparison in our minds. Nearly four years ago, we found ourselves in a truly dire financial crisis—where banks and markets faced real liquidity problems that threatened to freeze the entire system. We are far from that situation today. Corporations are in great shape—with the lowest levels of debt and the most cash on their balance sheets in generations. At the same time, earnings are strong, in no small part to emerging market growth contributions. The deleveraging process continues, and may for a few years (based on academic evidence of prior crises) but we appear to be in much better shape than we were a few years ago—even if some problems continue to persist, like unemployment, and despite how it might ‘feel’ to many Americans. However, investment asset prices continue to reflect the same type of fear present in 2008. Right now, the S&P 500 is trading at 12x, which is quite low compared to historicals and, especially considering the accommodative interest rate environment we see today. The market rallies over time have dwarfed the downturns.

So what do we do now?

As many of you know through experience, left to their own devices, some clients are extremely reactive to current events. This can lead to terrible investment decisions. We also know that ‘buy-and-hold’ or ‘stay the course’ are often not especially reassuring to hear over and over in volatile markets (although we’re not saying either is necessarily incorrect). Market timing or ‘gut feeling’ moves are quite often problematic because they’re done after the fact, after the ‘smart money’ has already been involved.

There are several ways to achieve investment results, whether the approach is based on ‘top-down’ or ‘bottom-up’ or ‘value’ or ‘growth’ or ‘momentum’ (just to name a few), but the key factor seems to be consistency—and not deviating from a systematic approach because conditions have temporarily changed. That is where behavioral errors like extreme fear/greed can erase years of discipline.

Market Notes

| Period ending 6/1/2012 |

1 Week (%) |

YTD (%) |

| DJIA |

-2.64 |

0.39 |

| S&P 500 |

-2.96 |

2.57 |

| Russell 2000 |

-3.75 |

0.07 |

| MSCI-EAFE |

-1.48 |

-3.79 |

| MSCI-EM |

-0.92 |

-2.46 |

| BarCap U.S. Aggregate |

0.33 |

2.20 |

| U.S. Treasury Yields |

3 Mo. |

2 Yr. |

5 Yr. |

10 Yr. |

30 Yr. |

| 12/31/2011 |

0.02 |

0.25 |

0.83 |

1.89 |

2.89 |

| 5/25/2012 |

0.09 |

0.30 |

0.76 |

1.75 |

2.85 |

| 6/1/2012 |

0.07 |

0.25 |

0.62 |

1.47 |

2.53 |

Stocks were the big losers on the week, with disappointing economic data and general poor sentiment. In contrast with a few previous weeks, emerging markets actually outperformed developed, which in turn outperformed U.S. stocks. In the domestic world, defensive utilities, telecom and staples held their ground a bit better, while energy, financials and consumer stocks suffered the most.

Unsurprisingly, bonds served as the main recipients of investor money last week. Despite negative real interest rates, investor money has continued to flood into fixed income—especially U.S. government debt—which has been referred to by many (including PIMCO’s Bill Gross) as one of the ‘cleanest dirty shirts’ in the laundry.

In the commodities world, economically sensitive products like oil and natural gas have continued to decline dramatically (which has also affected equities in the energy sector), as have industrial metals. Contrary to some unusual behavior exhibited during a pare back in pricing in recent months, precious metals were quite strong last week, presumably benefitting from the ‘fear’ trade.

Have a good week.

Karl Schroeder, RFC, CSA, AACEP

Investment Advisor Representative

Schroeder Financial Services, Inc.

480-895-0611

Sources: FocusPoint Solutions, Associated Press, Barclays Capital, Bloomberg, Deutsche Bank, Goldman Sachs, JPMorgan Asset Management, Morgan Stanley, MSCI, Morningstar, Northern Trust, Oppenheimer Funds, Payden & Rygel, PIMCO, Thomson Reuters, Schroder’s, Standard & Poor’s, U.S. Bureau of Economic Analysis, U.S. Federal Reserve, Wells Capital Management, Yahoo!, Zacks Investment Research. Index performance is shown as total return, which includes dividends, with the exception of MSCI-EM, which is quoted as price return/excluding dividends. Performance for the MSCI-EAFE and MSCI-EM indexes is quoted in U.S. Dollar investor terms.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product. Schroeder Financial Services, Inc. is a registered investment advisor.